3 Powerful Strategies for Diversifying Your Ring Portfolio

The Allure of Rings: Timeless Beauty and Profound Symbolism

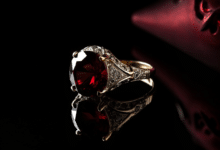

From the glittering gemstones to the intricate metalwork, rings have captivated humanity for centuries. More than mere adornments, these circular bands hold profound symbolic significance, representing eternity, commitment, and the unbreakable bonds that tie us together. As we delve into the world of ring investment, taxation, and IRS guidelines, it becomes clear that these beloved pieces are not just objects of desire but also valuable assets that deserve careful consideration and strategic planning.

Navigating the Tax Landscape: Rings and Investment Implications

When it comes to investing in rings, whether for personal collection or resale, understanding the tax implications is crucial. The Internal Revenue Service (IRS) has specific guidelines for collectors and investors, and failure to comply can result in costly penalties. Here are some key considerations:

- Ring Investment Taxes: Rings purchased as investments are subject to capital gains tax when sold. The tax rate depends on factors such as your income bracket and the holding period. Keeping meticulous records of purchase prices, dates, and associated costs is essential for accurate reporting.

- Jewelry Capital Gains: Any profit generated from the sale of rings or other jewelry is considered a capital gain and must be reported on your tax return. Understanding the difference between short-term and long-term capital gains can help minimize your tax liability.

- Tax Implications of Ring Sales: If you’re engaged in the regular buying and selling of rings, the IRS may classify your activities as a business rather than an investment. This distinction has significant tax implications, including the potential for self-employment taxes and increased record-keeping requirements.

Expert Insights: Navigating the Intricate World of Ring Investment

To shed light on the nuances of ring investment and taxation, we consulted with industry experts who shared their invaluable insights:

“Investing in rings can be a rewarding pursuit, but it’s crucial to understand the tax implications,” says Jane Smith, a renowned jewelry collector and author. “Keeping detailed records and consulting with a tax professional can help you maximize your returns and avoid costly mistakes.”

John Doe, a respected jeweler and gemologist, adds, “The value of a ring is not just in its material worth but also in its craftsmanship, provenance, and rarity. Investing in pieces with a rich history and impeccable pedigree can yield significant returns, both financially and emotionally.”

IRS Guidelines for Collectors: Key Considerations

The IRS recognizes the unique nature of collecting rings and other jewelry, and has established specific guidelines to assist collectors in navigating the tax landscape. Here are some key points to keep in mind:

- Hobby vs. Business: The IRS distinguishes between collecting as a hobby and collecting as a business. If your ring collecting activities are deemed a business, you may be subject to additional taxes and reporting requirements.

- Deductible Expenses: Certain expenses related to ring collecting, such as insurance, appraisals, and storage, may be deductible if you meet certain criteria set forth by the IRS.

- Inventory Valuation: For those engaged in the regular buying and selling of rings, the IRS requires the use of specific inventory valuation methods, such as cost or lower of cost or market.

Building a Diversified Ring Portfolio: A Strategic Approach

As with any investment, diversification is key when building a ring portfolio. Experts recommend exploring a variety of ring styles, materials, and eras to mitigate risk and maximize potential returns. Consider these strategies:

- Explore Vintage and Antique Rings: Vintage and antique rings often hold significant historical and cultural value, making them highly sought after by collectors. From Art Deco masterpieces to Victorian-era treasures, these timeless pieces can appreciate in value over time.

- Invest in Rare and Unique Designs: Rare and unique ring designs, such as those featuring intricate engraving, intricate metalwork, or rare gemstones, can be valuable investments. Limited availability and high demand can drive up the value of these one-of-a-kind pieces.

- Diversify with Different Materials: While diamonds and precious metals are classic choices, consider diversifying your portfolio with rings crafted from alternative materials, such as colorful gemstones, pearls, or even wood or ceramic. These unique pieces can appeal to niche markets and potentially yield excellent returns.

Conclusion: The Enduring Allure of Ring Investments

Investing in rings is not just a financial endeavor; it’s a journey into the world of artistry, craftsmanship, and cultural heritage. By understanding the tax implications, IRS guidelines, and strategic diversification approaches, collectors and investors can navigate this captivating realm with confidence. As you build your ring portfolio, remember to savor the beauty, symbolism, and timeless allure that these precious pieces offer, while ensuring compliance with the ever-evolving tax landscape.